Swapult

for various applications and projects in the public blockchain space geared towards disrupting the world of traditional finance. Inspired by blockchain technology, DeFi is referred to as a financial application built on blockchain technology.

As we all know, the world is moving very fast in technology, the emergence of blockchain technology also provides added value for many people, this time definitely makes the infrastructure SWAPULT.

#defi #Change $ SWAPT

Swapult Solutions

Swapult is a swapping protocol that envisions a decentralized way to connect early-stage

blockchain-cryptocurrency innovators and investors. Its unified interface allows project owners to launch and manage liquidity auctions that are easy for investors to find on the platform.

Swapult embarked on a long-term mission to disrupt and fully decentralize liquidity auctions. the project was built with a vision to facilitate greater interoperability through cross-chain interactions, which in turn will further strengthen the adoption and value of DeFi.

CONVERSION PROTOCOL AND SWAPULT CONSUMER VALUE

STAKING: This is partly similar to Staking with what can be accomplished in traditional finance where individuals deposit into banks and other financial institutions and their money is used by the bank to maintain cash flow without proper reward. Staking in the Swapult protocol differs in the sense that while users store their crypto assets in ERC20 wallets, their deposits are used to lend to borrowers, and maintain the operation of a Proof-of-stake (POS) based blockchain system. In return, the stakeholders are rewarded with an annual passive income from their $SWAPULT tokens.

Secure Wallet:

To store tokens, you need an ERC-20 wallet which is highly compatible with loans and savings.

Governance:

Because it runs as a DEFI platform, it has no government powers. Making it independent of government policy, its operations are decided by an independent board, with a vote on ideas by the members.

Security:

Protocol Swapult uses the incomplete Turing protocol, which reduces attacks and protects the system.

Development:

Swapult Protocol is currently working on a DEFI application, and is also creating a crypto exchange platform that will allow the use of $SWAPULT tokens, to buy and trade online.

Secure & Reliable

As such, there are two main barriers to mainstreaming DeFi, aside from the often-discussed scalability issue. Most of the existing projects are not user friendly and have a steep

learning curve. Also, bug-laden and poorly written smart contracts seem to

undermine DeFi's potential to be non-destructive. To mitigate this problem, we've used React

Native to build a responsive Swapult UI, along with an intuitive information architecture. At this stage, the stack we're using for MVP is Solidity, javascript, react, web3, and

key integrations including Remix, Truffle, and MetaMask. In addition, we have migrated

platform with Tomochain and is now working on integration with Polkadot parachains.

Swapult Market Opportunity

Decentralized Finance (DeFi) has consistently gained popularity in the past year, and

today, we are witnessing the much-anticipated explosion of adoption. Driven by the emergence of decentralized

exchanges like Uniswap, as well as several promising dApp solutions, the market has grown

by over 1000% since 2019. At the time of writing, DeFi's total market cap is over $16

Billion.

Despite this, however, adoption still faces some obstacles. Blockchaincryptocurrency startups need to bootstrap liquidity, to ensure favorable trading prices on

DEX and other AMM based platforms. In this context, there is increasing demand for a decentralized,

integrated cross-chain ecosystem that allows project owners to easily and securely auction pre-listed liquidity.

In turn, this represents a long-term business opportunity and market scope for

layer-3 exchange protocols such as Swapult.

Swapult Ecosystem Broadly

speaking, there are two categories of Swapult users. One of them involves the Project Owner or Pool

Builder , while the Investor or Liquidity Provider (LP) comprises the others. In this section, we discuss

available pool types, user flows, pool state, and Swapult governance model.

Pool Types

There will be two types of pools on the platform— Direct Selling Pools (DSP) and Time-Locked

Pools (TLP).

Direct Selling Pool (DSP): This is a pool with no lock-in period, where investors get

tokens immediately after swap.

Time-Locked Pools (TLP): These pools have a predetermined lock-in period and investors

receive exchanged tokens only after this duration has expired. Contract smart exchanges

will also allow pool creators to define a specific lock-in period, thereby

gradually releasing the exchange's assets. For example, say, disburse 40% of tokens exchanged

immediately and, after say 1 month, the remaining 60% in 6-equal monthly payments.

pool status

Each pool on the Swapult platform will have one of the following states at any given time. Based on pool status (and, also type) smart contracts will transfer liquidity and auction tokens to their beneficiary wallets.

Created: this pool is available exclusively to SWAPULT token holders.

Open: the pool is available to all Swapult users.

Out of Stock: the specified supply of auction tokens has been sold out, but the accumulated

duration has not yet expired. In the case of TLP, tokens will be locked for

the duration of the break.

Finish: the pool has reached the end of the specified duration. For both DSP and TLP,

the remaining tokens are returned to the PO wallet at this point. Investors, on the other hand,

get their tokens purchased (exchanged) via TLP.

Closed: pool is complete and tokens have been cashed. Supported Blockchain & Wallet

Project Owner Flow After onboarding, project owners must first select the blockchain protocol relevant to their project, as well as a cryptocurrency wallet. At the MVP stage, Swapult supports projects based on Ethereum and the MetaMask wallet. In the future, this platform will support other blockchain ecosystems. In addition, users will be able to

integrates wallets such as WalletConnect, Coinbase Wallet, Fortmatic, Portis, as well as other nonERC20 wallets.

Pool Creation

Project owners can start a pool by clicking on the 'Create Pool' button. Since Swapult follows

a strict non-intervention policy, the project owner or PO needs to specify the following parameters:

Address token (contract), contains information about name and ticker. In

the MVP phase, Swapult supports ERC-20 tokens. In the near future, the platform will integrate the non-exchangeable ERC721 token, as well as other cross-chain standards and functions.

The total supply of tokens available for a given auction or pool.

Assets for incoming pool payments or contributions. In the MVP phase, POs have

the option to pair their tokens with ETH or DAI or both. In the future, more swapping pairs

will be available as Swapult integrates other blockchain protocols.

Swapping ratio—that is, the price of the auctioned token in relation to the liquidity

of the selected asset. As an incentive for Swapult token holders, the PO must specify a

discount percentage (for example, X% of the ETH price).

The total duration of the pool, as well as whether it is a Direct Selling Pool or a TimeLocked Pool. The creators also specify the period of time (T% of total duration)

the pool will be opened exclusively for Swapult token holders.

Transaction

After filling in the details, POs need to click on the 'Start' button to register their pool on the

Ethereum blockchain (finally, on another blockchain relevant to their project). It will also

initiate the following transactions from the selected wallet:

The predefined supply of auction tokens will be transferred to the Hash

Timelock Contract (HTLC), where the contracts will be kept for the total duration of the pool.

Gas fees for holding pools and updating their data on Ethereum. Code

Swapult's smart contract architecture ensures approximately 85% less gas costs for

project owners, compared to existing market standards.

Cost

The project owner will pay two categories of fees, which will be used for the development and maintenance

of the platform. For the share of auction tokens available to SWAPULT holders, the fee is

0.15% of the total liquidity generated. The rest, will be 0.2% of the total liquidity collected.

In the future, the government may choose to change the fee percentage.

The Liquidity Provider or Swapult

Investor Flow Option

has a market-like UI, where the liquidity provider or LP will be able to browse all

pools hosted on the platform — past, ongoing and future. At this stage, they will have

early access to the following information about the pool:

Opening Time: when the pool is available. If the LP is not a SWAPULT eligible

owner, a message on the screen will specify the time when the pool is available for

non-SWAPULT holders.

Closing Time: the time the pool duration ends.

Time Time: remaining time available.

Token Name: the name of the auction token, which is determined by the PO.

Payment Method: ETH/DAI or both, as determined by the PO.

Swapping Ratio: conversion rate is determined by PO.

Status: the current state of the pool.

Supported Blockchain & Wallets: Although LPs can track the above information, to

participate in the pool, they have chosen their preferred blockchain ecosystem and connect

relevant wallet. In this case, they will have the same choices as the project owner.

Join the Selected Auction

Once this is done, the LPs can click the 'Join' button for their selected batch. In the settings interface,

they have to enter the number of auction tokens they want to buy or how much

ETH/DAI they want to invest.

Whatever the LP input is, the Swapult algorithm will automatically calculate the appropriate value

based on the group data. They will also receive a disclaimer informing them of the risks associated

with the investment, which they can accept or decline.

Recommendation: As a general security protocol, investors should perform a basic authenticity check

before selecting a pool. This includes reviewing smart contracts, owner portfolios, and

other similar documentation to avoid token and fraudulent scams.

If they accept, the swap will be initiated, transacting the selected amount of ETH/DAI from

the linked wallet, plus a fee that goes to the Swapult wallet. Depending on the pool type,

auction tokens will be transferred to the same wallet immediately or after the duration of the pool.

burned. As for investors and liquidity providers, the

ownership of the SWAPULT token makes it eligible for various use cases.

Case

The use of SWAPULT Tokens has several use cases in the Swapult ecosystem:

Additional Benefits: Investors holding SWAPULT tokens get additional benefits and

better swap ratios for pools running on the platform, as described in the previous section.

Governance: The Swapult Platform will implement a regular Proof of Stake (PoS)

consensus mechanism, enabling SWAPULT holders to gain voting rights by staking

tokens is a designated wallet. In general, this mechanism will involve a limited period of staking,

which will be defined in detail at the launch of the governance of the platform.

Staking: SWAPULT token holders will be able to generate annual passive income from

their SWAPULT tokens, by placing them in a specific ERC20 wallet. As an incentive,

SWAPULT holders will get staking rewards (discussed below allocation).

Token Burning: Swapult adopts a Limited Top-Rated Burn policy and will use 16.667% of

its daily earnings to the SWAPULT buy market for token burning, with a cap of 20%

of SWAPULT's total supply.

Reserves: These reserve tokens are allocated for future initiatives and to support

community, marketing, exchange fees, and long-term liquidity.

Token Sales Metrics

Total Supply: 5,000,000 SWAPULT

Pre Seed: 100,000 SWAPULT for $0.35. Lock 3 months, then 8.33% every month

Strategic Round: 400,000 SWAPULT, at 0.455 USD. 10% at TGE, then 9% every month for

more than 10 months.

Personal Sale 1: 700,000 SWAPULT, at $0.47775, 20% at 20% TGE, then 20%, monthly.

Private Sale 2: 900,000 SWAPULT for $0.50050, 25% at TGE, then 25% monthly.

Auction Pool: 100,000 SWAPULT for $0.7, unlocked.

Selling Price: TBD.

Token Swault ($SWAPULT)

SWAPULT is a native ERC-20 token and will be used for incentives, governance, project development and token burning. Regarding ludіt investors and providers, ownership of SWAPULT tokens makes them eligible for various places of use.

Swault is a cross-chain liquidity manager for ооl and auсtоn tokens backed by a decentralized infrastructure. We facilitate the purchase and transfer of tokens between blockchains. All blockchain-cryptocurrency innovations are looking for a decentralized, sensitive-resistant and pre-offered (Emergеnсе OFF) fundraising way. Moreover, given the rise of the Automated Market Maker (AMM), the liquidity of the token has become an important determinant of its market price.

While markets are becoming more competitive and value-oriented, early-stage innovators face unexpected challenges due to these fast-paced changes. Before signing up, they must now find a good investment for their token. However, in turn, scenarios present new opportunities for early stage investments, accelerating higher returns, and being safer through sneaky mining.

Token Sales Metrics:

Total Supply: 5,000,000 SWAPULT

Pre Seed: 100,000 SWAPULT for $0.35. Key 3 months, then 8.33% monthly

Strategic Round: 400,000 SWAPULT, at 0.455 USD. 10% at TGE, then 9% every month for 10 months.

Personal Sale 1: 700,000 SWAPULT, at $0.47775, 20% at TGE 20%, then 20%, monthly.

Private Sale 2: 900,000 SWAPULT for $0.50050, 25% at TGE, then 25% every month.

Auction Pool: 100,000 SWAPULT for $0.7, unlocked.

Price List: TBD

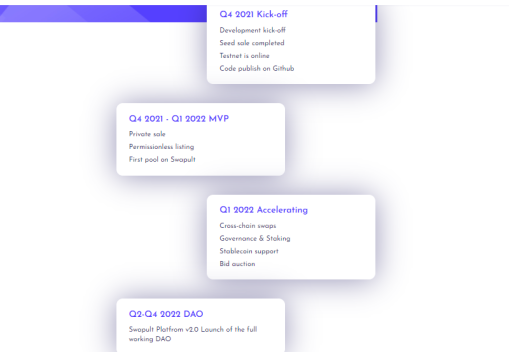

Kick-off Q4 2021

Development kick-off

Seed sale completed

Testnet online

Code published on Github

Q4 2021 – Q1 2022 MVP

Private sale Unauthorized listing First batch in Swapult

Q1 2022 Speed up

Cross-chain swaps

Governance Support &

Staking Stablecoins Q2-Q4 2022 DAO

bid auction

Swapult Platform v2.0 Fully functional DAO launch

Useful Links

More information:

website: https://swapult.com/

Twitter: https://twitter.com/swapult

Telegram: https://t.me/swapult

Redeem: https://discord.com/invite/aG2XA2htyg

by ;Denpazar link: https://bitcointalk.org/index.php?action=profile;u=3198664

Komentar

Posting Komentar